Financial scandals have a way of shocking the world with their audacity and scale, leaving behind a trail of disbelief and skepticism. One such scandal that rocked India's financial landscape was the Telgi Stamp Paper Scam, a multi-crore conspiracy that involved counterfeit stamp papers and shook the foundations of the country's judicial and administrative systems. With an estimated value of 30,000 crore rupees, the Telgi Scam remains one of the most significant white-collar crimes in India's history.

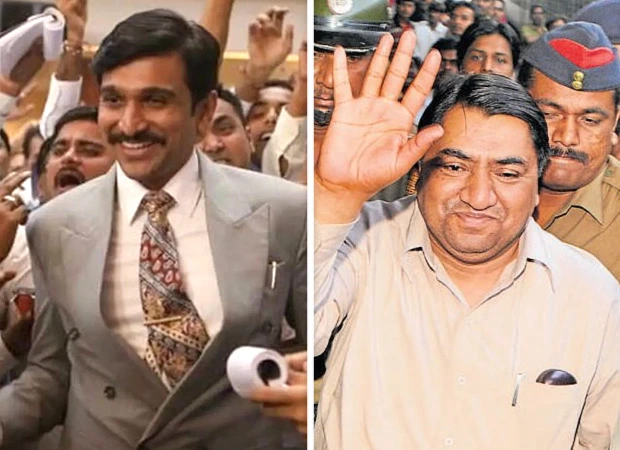

The Mastermind Behind the Scheme:

Abdul Karim Telgi, the man at the center of the scam, was a master forger and a criminal prodigy. Operating from Pune, Maharashtra, Telgi created a vast network that produced counterfeit stamp papers and other government documents. His connections reached deep into the bureaucracy, law enforcement, and even political circles, which enabled him to run his operation for over a decade.

The Mechanics of the Scam:

Telgi's operation involved producing fake stamp papers and selling them to banks, insurance companies, and other institutions that required legal documents. These forged papers were used for transactions, thus evading taxes and generating unaccounted money. By exploiting the gaps in the system and leveraging corruption, Telgi managed to distribute these counterfeit papers across multiple states in India.

The Ripple Effect:

The consequences of the Telgi Scam extended far beyond financial losses. The legitimacy of countless property transactions, loans, and other legal transactions came under question. Courts were flooded with cases to ascertain the authenticity of the stamp papers used in various agreements. This not only overwhelmed the judicial system but also led to widespread public distrust in the legal process.

Unveiling the Scam:

The unraveling of the scam began in 2001 when the police in Pune arrested Abdul Karim Telgi. A nationwide investigation revealed the staggering extent of his operation and the level of corruption involved. Telgi's arrest initiated a long legal battle, and his confessions exposed the depth of collusion between criminals, bureaucrats, and politicians.

The Legal Proceedings:

The legal proceedings that followed the arrest of Telgi were complex and protracted. The investigation led to the exposure of numerous government officials and politicians who had aided and abetted the scam. Over 4,000 cases were registered against Telgi and his associates across multiple states. Despite his attempts to manipulate the judicial system, Telgi was ultimately sentenced to multiple terms of imprisonment.

Conclusion:

The Telgi Stamp Paper Scam remains a grim reminder of the lengths to which individuals can go to exploit systemic weaknesses for personal gain. While the scandal resulted in severe financial losses and legal chaos, it also prompted a reevaluation of the existing administrative and legal mechanisms in India. The need for vigilance against corruption, coupled with timely and effective reforms, is a lesson that society must heed to prevent history from repeating itself.