Financial - Feb 5, 2024

Paytm Crash: Invest or Ditch? 2024 Insights

Paytm, the once-unstoppable Indian fintech giant, finds itself in choppy waters. Its recent share price plunge, hitting 20% lower circuits for two consecutive days, has sent shockwaves through the market and left investors questioning its future. This blog dives deeper into the current news, analyzes the company's situation, and explores potential investment options for those considering entering the fray.

Paytm's Perfect Storm:

Several factors have contributed to the current predicament:

● RBI's Paytm Payments Bank Ban:

The Reserve Bank of India (RBI) imposed restrictions on Paytm Payments Bank, prohibiting new customer acquisitions and top-ups, citing "significant supervisory concerns." This dealt a major blow to Paytm's core payments business and shook investor confidence.

● Mounting Losses and Unproven Profitability:

Despite its massive user base, Paytm has yet to turn a profit, raising concerns about its long-term sustainability and ability to generate shareholder returns.

● Heightened Competition:

The Indian fintech landscape is fiercely competitive, with players like PhonePe and Google Pay vying for market share. This competition makes it challenging for Paytm to stand out and grow its revenue.

● Market Correction and Regulatory Headwinds:

The overall market volatility, coupled with potential regulatory changes in the fintech sector, further fueled the uncertainty surrounding Paytm's future.

Should You Jump Ship? Not So Fast:

While the situation appears bleak, there are reasons for cautious optimism:

● Loyal User Base:

Paytm boasts over 333 million monthly active users, signifying a strong brand recognition and potential for future growth

● Diversified Business Model:

Paytm's offerings extend beyond payments, encompassing wealth management, e-commerce, and other financial services, presenting opportunities for diversification and revenue generation.

● Strategic Partnerships:

Paytm has forged partnerships with major players like Walmart and Microsoft, indicating its potential to expand its reach and offerings.

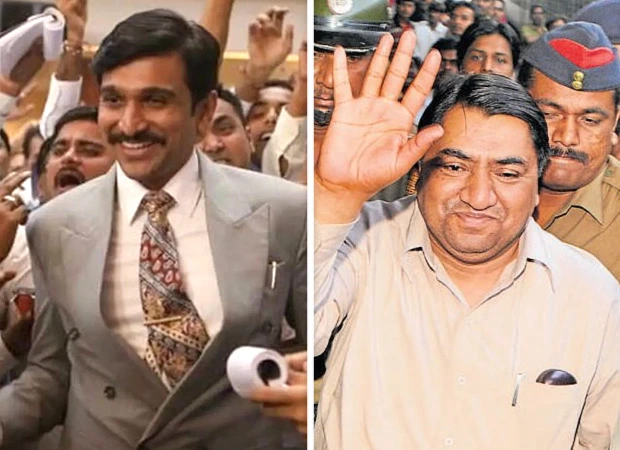

● Founder's Tenacity:

Vijay Shekhar Sharma, Paytm's charismatic founder, has a track record of overcoming challenges and navigating turbulent markets. His commitment could drive the company towards a turnaround.

Investing in Paytm: Weighing the Risks:

Investing in Paytm at this juncture is a high-risk, high-reward proposition. Here's what to consider:

● Investment Horizon:

Are you looking for a quick buck or a long-term bet? Paytm's turnaround requires time and patience. Short-term investors might face volatility.

● Risk Tolerance:

Can you stomach potential losses? Paytm's future remains uncertain, and its stock price could remain volatile.

● Alternatives:

Consider other fintech players like PhonePe, Policybazaar, or ETFs tracking the Nifty 50 for broader exposure.

Beyond the Headlines: Further Exploration:

To make an informed decision, delve deeper into the news:

● Analyze the RBI's report on Paytm Payments Bank:

Understand the specific "supervisory concerns" and assess the potential impact on the business.

● Evaluate Paytm's financial statements:

Look at recent trends in revenue, losses, and user growth to gauge its financial health and potential.

● Stay updated on regulatory developments:

Monitor any changes in regulations that could affect the fintech sector and Paytm in particular.

Conclusion:

Remember: Investing is not a spectator sport. Conduct thorough research, understand the risks, and make informed decisions aligned with your financial goals and risk tolerance. Paytm's future is uncertain, but for the bold investor willing to navigate the storm, it might hold potential rewards.Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.