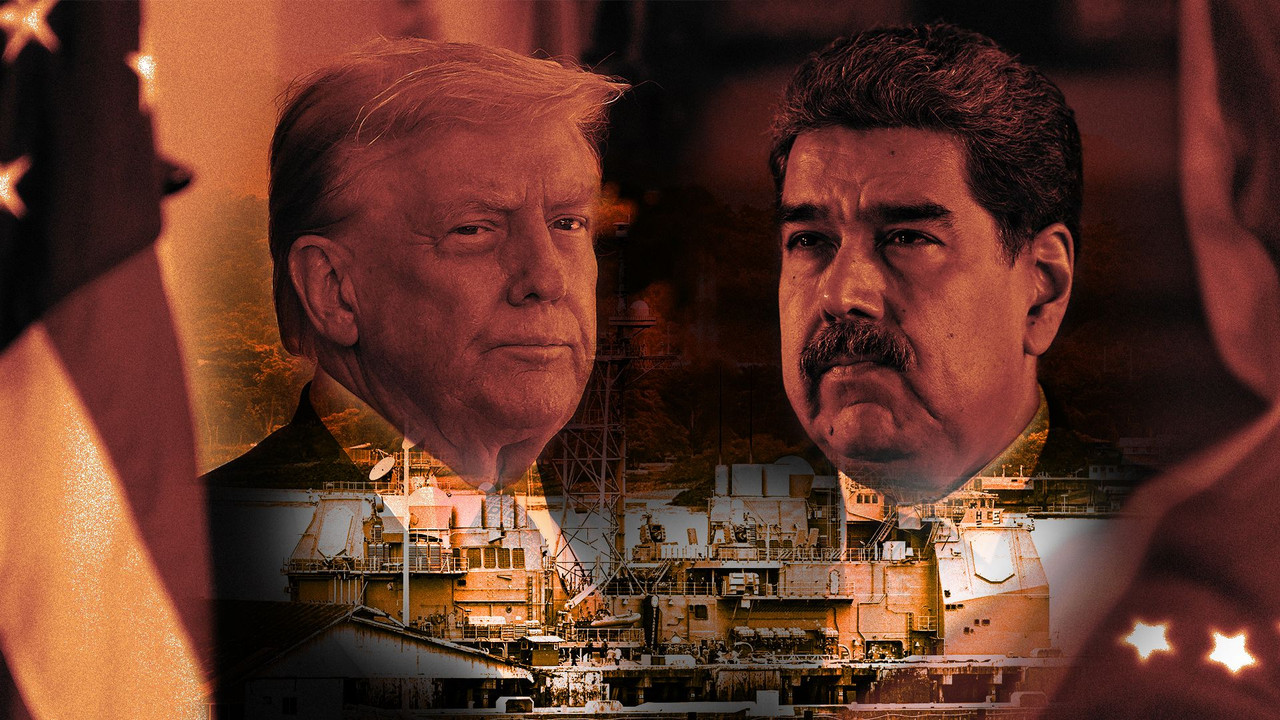

In recent political discussions, former US President Donald Trump has once again brought attention to Venezuela, raising concerns and speculation about America’s intentions toward the South American nation. Venezuela has long been at the center of geopolitical tension due to its massive oil reserves, unstable government, and humanitarian crisis. This blog explores why Trump has shown strong interest in Venezuela, what effects such control or influence could have, how global markets might react, and how the international community should respond.

Why Trump Wants Control or Influence Over Venezuela

Venezuela holds the largest proven oil reserves in the world, making it strategically valuable to any global power. For the United States, gaining influence over Venezuela could mean reducing dependence on Middle Eastern oil and countering rivals like China, Russia, and Iran, all of whom have strong ties with the Venezuelan government.

During Trump’s presidency, his administration took a hard stance against Venezuela’s leadership, imposing sanctions and supporting regime change narratives. Trump’s approach aligns with his broader “America First” policy, where economic leverage, energy dominance, and political strength are key priorities. Controlling or influencing Venezuela would also allow the US to reshape power dynamics in Latin America.

What Has Been Affected So Far

Venezuela’s economy has already been severely damaged by sanctions, political instability, and internal mismanagement. US pressure has limited Venezuela’s ability to trade freely in global oil markets, worsening inflation, unemployment, and migration crises.

On a global scale, tensions surrounding Venezuela have contributed to oil price volatility, especially during periods of supply disruption. Latin American politics have also been affected, as neighboring countries struggle with refugee inflows and regional instability.

What Could Happen If the US Took Control

If the United States were to gain direct or indirect control over Venezuela, the consequences would be dramatic. A new government aligned with US interests could reopen oil exports, stabilize production, and attract foreign investment. This might initially benefit global energy markets by increasing supply and lowering oil prices.

However, such control could also spark major backlash, including internal resistance within Venezuela, regional unrest, and stronger opposition from global powers like Russia and China. It could set a controversial precedent regarding national sovereignty and foreign intervention.

How Global Markets Could React

Financial markets tend to react strongly to geopolitical shifts. If Venezuela’s oil supply were restored under US influence, energy stocks and oil prices could see short-term declines due to increased supply. Emerging markets could experience volatility, especially in Latin America.

At the same time, defense stocks, energy infrastructure companies, and US oil refiners might benefit. Currency markets could also fluctuate, particularly the US dollar and Latin American currencies, depending on investor confidence and political stability.

How the World Should React

The global community should prioritize diplomacy over dominance. International organizations like the United Nations should encourage peaceful negotiations, fair elections, and humanitarian aid rather than unilateral control. Respect for sovereignty, regional cooperation, and economic recovery plans should guide global responses.

Rather than backing power-driven interventions, the world should focus on stabilizing Venezuela through multilateral agreements that support democracy, economic reform, and the well-being of its people.

Conclusion:

Donald Trump’s interest in Venezuela reflects broader geopolitical goals tied to energy security, global influence, and economic power. While gaining control could reshape oil markets and regional politics, it carries serious risks for global stability. How the world responds—through cooperation or confrontation—will ultimately determine whether Venezuela becomes a symbol of recovery or continued conflict.